Low Unemployment, Interest Rates Keep Homes Affordable Even as Prices Rise

In November 2015, the median sales price of single family home prices in Ada County, as tracked through the Intermountain MLS, was at $240,300 up 11.5% compared to November 2014. Breaking that down by sales type, the median sales price of existing single family homes was $213,000, up 7.2% year-over-year, while the new construction median sales price was $356,209, up 11.9% year-over-year.

According to a survey from the National Association of REALTORS®, the median price in Idaho is expected to increase by 3-4% over the next 12 months (looking ahead to October 2016), for existing and new homes combined. While the survey doesn’t break those numbers down to other geographies, in Ada County, we’ve seen prices increase over the past 12 months (from October 31, 2014 to November 30, 2015) by 8.7% for all homes—the median sales price for existing homes was up 8.8% year-to-date, and by 3.9% year-to-date for new construction homes.

There are a variety of factors that will determine where prices end up a year from now, especially local unemployment rates. The latest numbers from the Idaho Department of Labor show a 2.9% unemployment rate for Ada County, as of October 2015. Boise City had the lowest rate across the state at 2.4%, and Meridian came in at 3.6%. These were all well under the 5% rate nationwide.

“There is always a concern that when prices rise, homes will become unaffordable for some people,” said Brenda Kolsen, 2015 President of the Ada County Association of REALTORS®. “We’ll certainly continue to watch affordability in our region, but with the positive jobs numbers, recent wins by BVEP which is bringing new companies to the Valley, and continued interest from people wanting to move to our area, we feel that our local real estate market is in a great position for buyers and sellers alike—and we expect it to be that way for some time.”

Additionally, low down payment programs and the continuation of historically low mortgage rates have allowed people to purchase homes even as prices have risen. In November 2015, HSH.com reported mortgage rates at 3.988%.

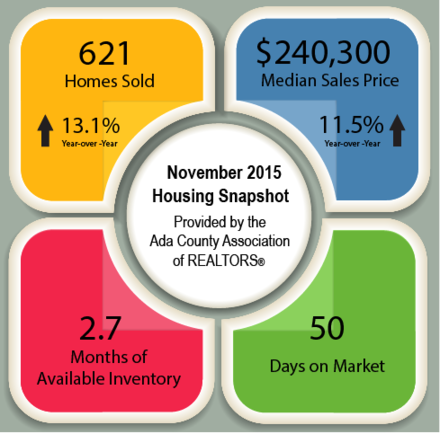

In addition to price, here is how the rest of the market performed in November 2015, looking at all single-family home activity in Ada County, as reported to the Intermountain MLS, a subsidiary of the Ada County Association of REALTORS®:

- Closed Sales were at 621, up 13.1% year-over-year, and up 18.4% YTD

- Median Sales Price was at $240,300, up 11.5% year-over-year, and up 8.7% YTD

- Days on Market was at 50 days, down 10.9% year-over-year, and down 9.1% YTD

- Pending Sales were at 1,152, up 39.3% year-over-year (not tracked YTD)

- Inventory was at 1,919, down 15.2% year-over-year (not tracked YTD)

- Months of Inventory was at 2.7 months, down 28.9% year-over-year (not tracked YTD)

# # #

The information in this market report is based on a variety of sources, but primarily on the public statistics provided by the Intermountain MLS (IMLS), a subsidiary of ACAR, available here: http://publicstats.intermountainmls.com/static/Reports/Ada/2015/November-2015-Ada.pdf. These statistics are based upon information secured by the agent from the owner or their representative. The accuracy of this information, while deemed reliable, has not been verified and is not guaranteed. These statistics are not intended to represent the total number of properties sold in Ada County during the specified time period. The IMLS provides these statistics for purposes of general market analysis but makes no representations as to the past or future appreciation or depreciation of property values. (To reduce the error, only data falling within 3 standard deviations from the mean has been included in the report. Existing and new construction statistics are calculated independently and may not sum to the total number of homes sold.) Changes to methodology: Effective 3/1/2007, ‘days on market’ refers to the number of days that transpire between the listing date and the date the property goes into pending status. Effective 4/1/2011, standard deviation is modified to reflect the difference between the asking and sold prices as a percentage of the asking price.